More about Family Governance

Protecting your family and wealth

What is Family Governance?

Family Governance is an agreement / contract between different family members to adhere to common values and goals. It regulates both the mutual relationships and the relationships between the family and the company. This can be an oral agreement, but it is better to lay down the rules, agreements and family policy.

The contract can also be called a statute. It includes the structure for decisions and communication, but also agreements on strategy, policy and the involvement of the various family members. Family Governance ensures that the family business is maintained, the assets are protected and the family does not end up in conflict.

The connection between the family business, the family itself and the accumulated wealth.

As the director of your family business, you have known both ups and downs, but you have always made it through. As you get older, you realise that you cannot always be in charge. One day you will have to transfer the responsibility for the family, the company and the assets to the next generation. This is not anything that should be taken lightly and should be done carefully.

Every family and certainly every family business is unique. There is no blueprint for an ideal transfer. Every situation requires an individual approach. And that starts with asking the right questions. These questions can be answered by Family Governance:

- How can we avoid disputes about the family business or assets?

- How do the family members view the family capital. Do they see this as a gift or a burden?

- Is the next generation ready to run the business?

- What role is there for the children or the spouse?

- How can the next generation be properly prepared for the responsibilities in the family business and for the capital?

- Do the children have to stand on their own two feet first?

- Are the marriages of the children a cause for concern?

- Does the company have sufficient liquid assets is the company?

- Has retirement from the company been arranged properly?

- Is everyone emotionally ready for the business transfer?

- How do we recognize the ideal moment for the transfer?

"Money Talks, Bullshit Walks"

- Thomas Langerwerf

Why is Family Governance important?

It is often thought that Family Governance is a luxury and a transfer happens automatically. When we look at the statistics, we can see that 36% of the family businesses are transferred to the second generation. For the third generation, this is only 19% and for the fourth only 7%. Various factors influence this, but research shows that internal factors are more often the reason that a company does not continue than external factors. Lack of careful handover planning and poor communication are major causes. This is not surprising, given that a small percentage of families with family businesses have established procedures for, for example, communication and the handling of disputes. When these are not properly arranged, the functioning of different family members, a difference of opinion about the strategy, or disagreement about the role of in-laws can lead to disputes. This can be prevented by means of a family statute.

The establishment of Family Governance can bring structure to things that are usually unwritten. This ensures that processes run smoothly and communication is clear. Which makes it easier to make agreements and enables you and your family to make common and effective decisions. The process is often at least as important as the outcome, the company must be able to continue.

The norms, values and rules about behavior and communication give family members a grip on the future. It should provide a basis so that formal relationships between family members can be balanced. It stimulates the family to think about the different roles of members and to work out future scenarios. By writing down unwritten rules, indecisiveness will hardly occur in the future.

What does Family Governance cover?

It breaks down into two areas:

- Agreements on common standards

- Values and a family mission and vision

This is recorded in a statute (also known as a shareholders' agreement) or by the minutes of a family council.

Additional agreements can be made, for example: how is the family business managed? How are meetings, relationships and communication organised? What are the remuneration, powers and employment relationships? And how is the financial planning set up? It is good to determine all the agreements before establishing the Family Governance.

There are two types of documents, being: legally binding and non-binding. Although the non-binding documents have no legal significance, they can be important. They are, for example, statements about:

- Family values

- Code of conduct

- Policy during conflicts of interest

- Hiring policy

- Remuneration policy

- Job descriptions

- Training and development

- Dividend policy

- Charities

- Philanthropy policy

And there are the legally binding documents. It is important to adapt these documents to each other to be consistent and avoid discrepancies. You can think of a will or multiple wills, prenuptial agreement, power of attorney or a family statute and management protocol. In addition, the investment statute and the shareholders, foundation or trust agreement also belong to this list.

Roles and interests

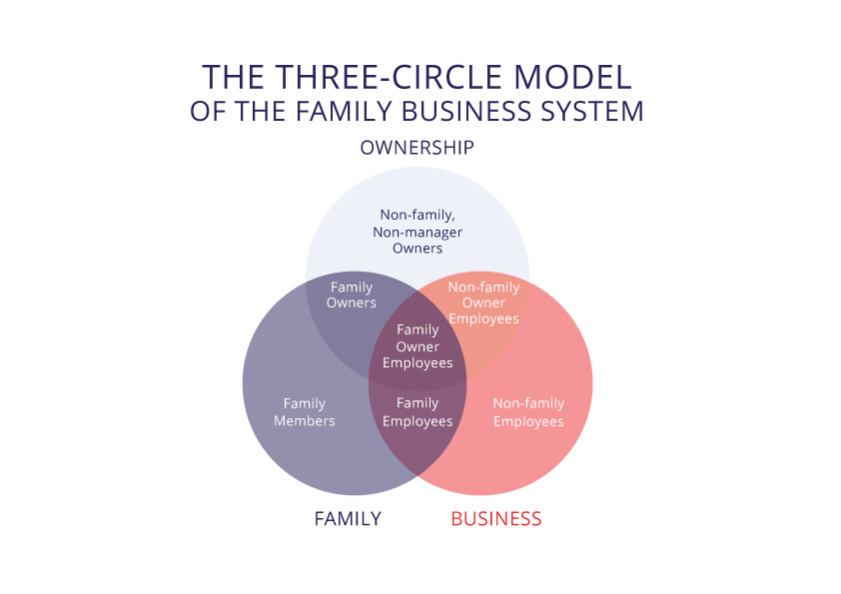

The roles and interests depend on the position of the family members in the family, in the property and in the family business. Davis and Tagiuri have drawn up a model for this, this is a Venn diagram with 3 circles. These circles represent family, business and ownership. In the overlapping parts there are different roles, each with its own interests, below are some examples:

- External shareholder

- Management and personnel

- Manager / shareholder

- Inactive family / shareholder

- Family

- Family who works in the company

- Family shareholders who form management

For successful family businesses, the roles and interests are often in balance, through good family dynamics, professional management and responsible ownership a company is optimally managed. When the balance is disrupted, for example by several shareholders, this can lead to less involvement (unless the shareholders work in the company themselves or when the number of managers is a lot less than the number of shareholders).

At Family First we constantly think about structure, power, taxation, clarity and especially the prevention of ambiguities. Family First can help you with all your affairs in the areas of family, the family business and your (family) assets. We are happy to help you.

Curious about what we can do for you?

At Family First we constantly think about how to add or manage structure, power, taxation, clarity and especially the prevention of ambiguities. Family First can help you with all your affairs in the areas of family, the family business and your (family) assets. We are happy to serve you!